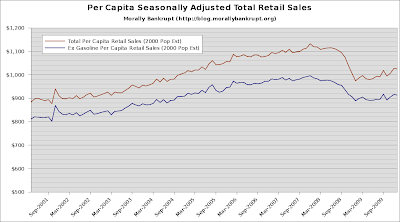

Well, we got new retail sales numbers from the Census Bureau. Calculated Risk reported an increase but, just like last month, these numbers are a little less bright when adjusted for population changes. Please take in mind this is a census year, and we'll have a new population estimate soon, but if the gap between the 1990 and 2000 estimates is any indication, the difference shouldn't that large. While we continue to see minor weakness in the population-adjusted sales, it's starting to look like we are just moving sideways, which is not good news, but it's better than bad news.

One of the items that I find discouraging is the percentage of sales volume that is gasoline sales. While sales numbers are moving roughly sideways, the amount of money spent on gasoline has been increasing. The increasing sales volume of an item with a low short-run elasticity of demand just means people's income are increasingly tied up in covering the necessities and their disposable incomes are shrinking. That is not good news for the consumer. Where are all those gasoline savings Cash4Clunkers was supposed to bring us?

I also added a chart including per-employee retail sales, which show us some tremendous improvement in the retail sector. It looks like retail was able to adjust employee-levels quickly and the per-employee sales number is actually very close to the peak levels.

No comments:

Post a Comment

Do the right thing.